The 9 Biggest Consumer Behavior Trends That Will Shape 2024

Fansgurus SMM Panel (Social Media Marketing Panel) is a platform where you can purchase social media services such as likes, followers, comments, and views for various social media platforms such as Telegram Instagram, Facebook, Twitter, YouTube, TikTok, and more.https://fansgurus.com/

There’s no denying that consumers’ thoughts and actions play a significant role in your product offering, marketing, and design. With the rapid growth of technology in ecommerce, each year brings new trends.

We’ve gathered up some key data on this topic to show you:

- How to market your products during a recession

- How brands are taking a DTC-first approach

- The future of social commerce (hint: it’s not Facebook)

- And most importantly, the factors that drive consumer habits

1. Consumers want more control over spending

The cost of living crisis has caused people to change how they spend online, with 40% of people shifting toward methods that allow them to track spending more accurately.

As of April 2022, 21% of consumers surveyed by Paysafe said they’ll avoid buying on credit. This may result in lower demand for buy now, pay later (BNPL) payment methods.

Debit cards, credit cards, and digital wallets remain the most popular payment methods among shoppers:

- 59% use debit cards

- 51% use credit cards

- 33% use digital wallets

Retailers can stay on top by offering various payment options for consumers, like cash. Some 47% of consumers feel it would be easier to pay for online goods in cash.

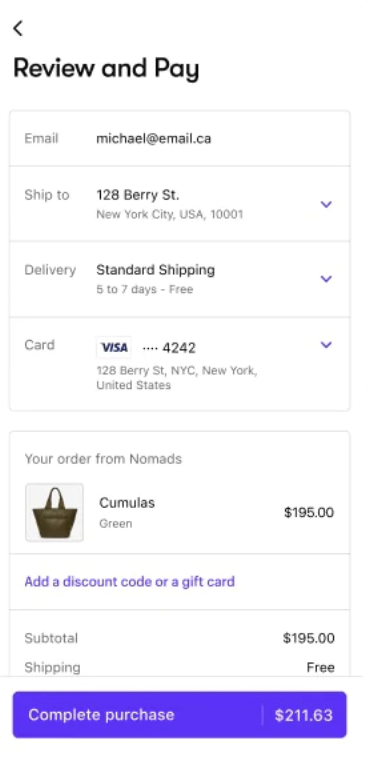

Embedded payments are another untapped opportunity for merchants, which is a fancy term for paying with a single click. While nearly half (49%) of consumers have never heard of embedded payments, many have used them without knowing.

![Screen Shot 2022-11-06 at 12.32.44.png]()

Source: Paysafe

For example, when customers make a one-click purchase with Shop Pay using stored information, they use an embedded payment system. Online shoppers using embedded payment (38%) feel the technology is more secure than traditional payment methods.

![Screen Shot 2022-11-06 at 12.34.07.png]()

Consumers want to stay in control and keep financial details safe and secure. From a retailer’s perspective, use the tools at your disposal to meet consumers where they are. Making payments faster and more convenient will help you build trust and encourage customers to shop more frequently.

Consumers are still buying, but the items they spend their money on must be well worth the investment. Solve problems well, as many of them as you can, with one product, then tell your consumers all how your product makes life better.

Consumers are still buying, but the items they spend their money on must be well worth the investment. Solve problems well, as many of them as you can, with one product, then tell your consumers all how your product makes life better.

Shelley Martin, founder of Skinician

2. Concerns over inflation and rising prices

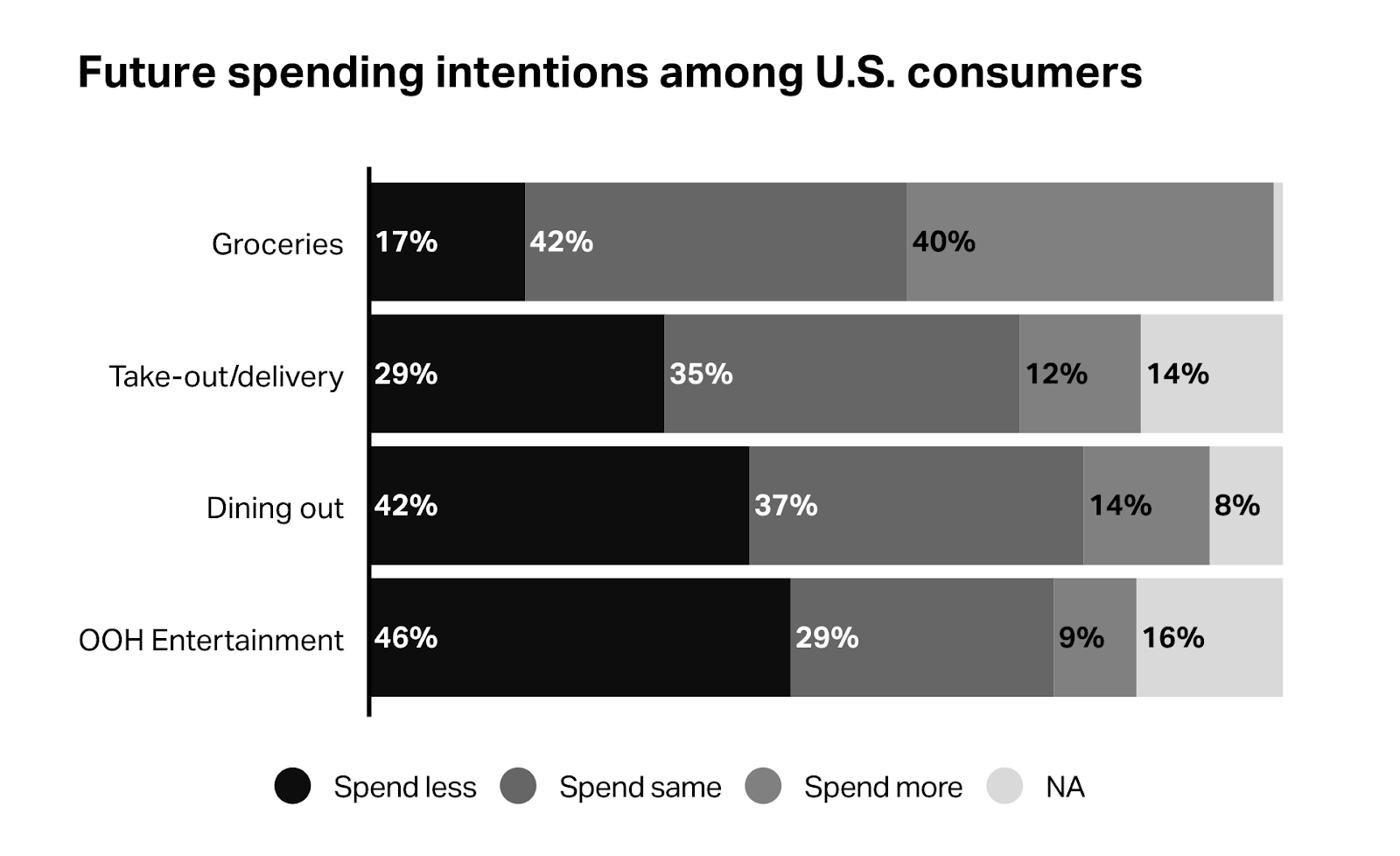

Record inflation and hefty price increases for essentials are a big concern for shoppers. As spending power decreases, 81% of consumers report changing how they shop to manage expenses, and a growing number of people (42%) identify as “not impacted financially, but cautious with spending.”

A NielsenIQ report found that consumers fear an upcoming recession and feel less secure in their finances than they did six months ago:

- 52% feel less secure in terms of economic stability.

- 29% feel less secure in their ability to meet daily expenses.

- 25% feel less secure in their household income level.

US consumers are cutting back on travel, restaurants, and other non-essential items to combat growing insecurity. They are making room to budget for groceries and other essentials.

![Screen Shot 2022-11-02 at 16.54.04.png]()

Source: NielsenIQ

US consumers report using different strategies to save money, like:

- Driving less

- Shopping online or closer to home

- Stocking up when items are on sale

- Using coupons

- Finding stores with lower prices

- Buying store brands

Inflation impact is happening across all spending categories, like apparel, footwear, household goods, dining out, gas. Companies must proactively prepare for behavior changes as people navigate rising concerns of inflation and recession.

3. In-store shopping remains a preference for many consumers

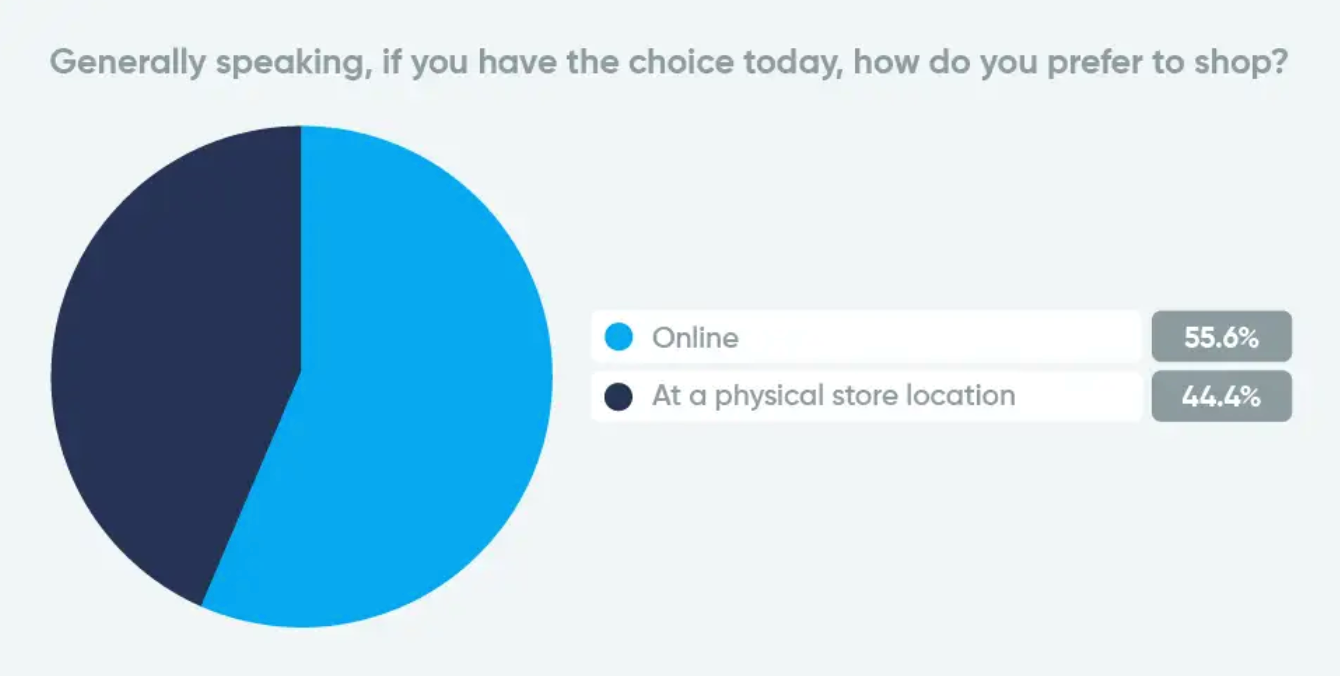

Though ecommerce has seen a significant uptick in past years, in-person shopping is still the preferred method for many consumers—especially for big-ticket items.

A recent study by Raydiant found that shopper’s were divided evenly between in-store and online shopping, with nearly 45% of consumers preferring to shop in-store.

![Screen Shot 2022-11-02 at 16.58.18.png]()

The study also found that:

- 27.6% of respondents said the allure of in-store experiences was their primary reason for shopping in brick-and-mortar stores.

- 54.6% of respondents have abandoned a brand because of a single bad in-store experience.

- 31.9% of consumers said product selection and variety are the greatest factors in the quality of an in-store experience.

How can you improve your store’s customer experience? Shoppers from the study suggest:

- Exclusive in-store deals

- Fun experiences

- Provide top-notch customer service

4. Demand for sustainable products

As shoppers become more conscientious, sustainable products become an important factor in purchasing decisions. According to research by IBM, 77% of consumers consider sustainability and environmental responsibility to be at least “moderately important” brand values.

Harvard Business Review also reports that sustainable products have a 5.6 times higher average sales growth than those not marketed as sustainable. A few forward-thinking companies like Patagonia and Levi’s have pioneered sustainability, but research shows that Gen Z consumers are driving the conversation.

A recent report from First Insight and the Baker Retailing Center at the Wharton School of the University of Pennsylvania found that senior retail executives have little understanding of consumers’ preferences around sustainable offerings and shopping.

The report also found that:

- Two-thirds of consumers from all generations will pay more for sustainable products

- 44% of consumers rank product sustainability higher than brand name

- Three-quarters of consumers say sustainability is somewhat or very important to them

Gen Z’s influence will only increase as younger members become adults. By 2030, Gen Z will earn 27% of the world’s income, surpassing millennials by 2031, according to Insider.

“The trend for sustainable, local products with low resource consumption has been around for a few years,” says Michael Wolters, CEO of Banutsu, a same-day delivery app for Shopify merchants.

“In 2023, however, consumers will pay attention not only to the product’s sustainability but also the intentions and philosophy of the producing company. Buyers want to become conscious consumers and prefer buying from trusted brands. And the criteria for being perceived as a trusted brand are stricter than ever before.

“The purpose of the company plays a major role here: Does the company pursue other socially relevant goals than just the goal of making a profit? These can be, for example, environmental protection, fair working conditions, or a contribution to the preservation of the planet. If a company successfully communicates these goals credibly, it will have a higher status for consumers in 2023.”

Consumers buy sustainable products and brands primarily because they want to help the environment. If you want to capture future market share, it’s critical you become aligned with Gen Z’s values, before it’s too late.

5. Consumers are buying more stuff repeatedly

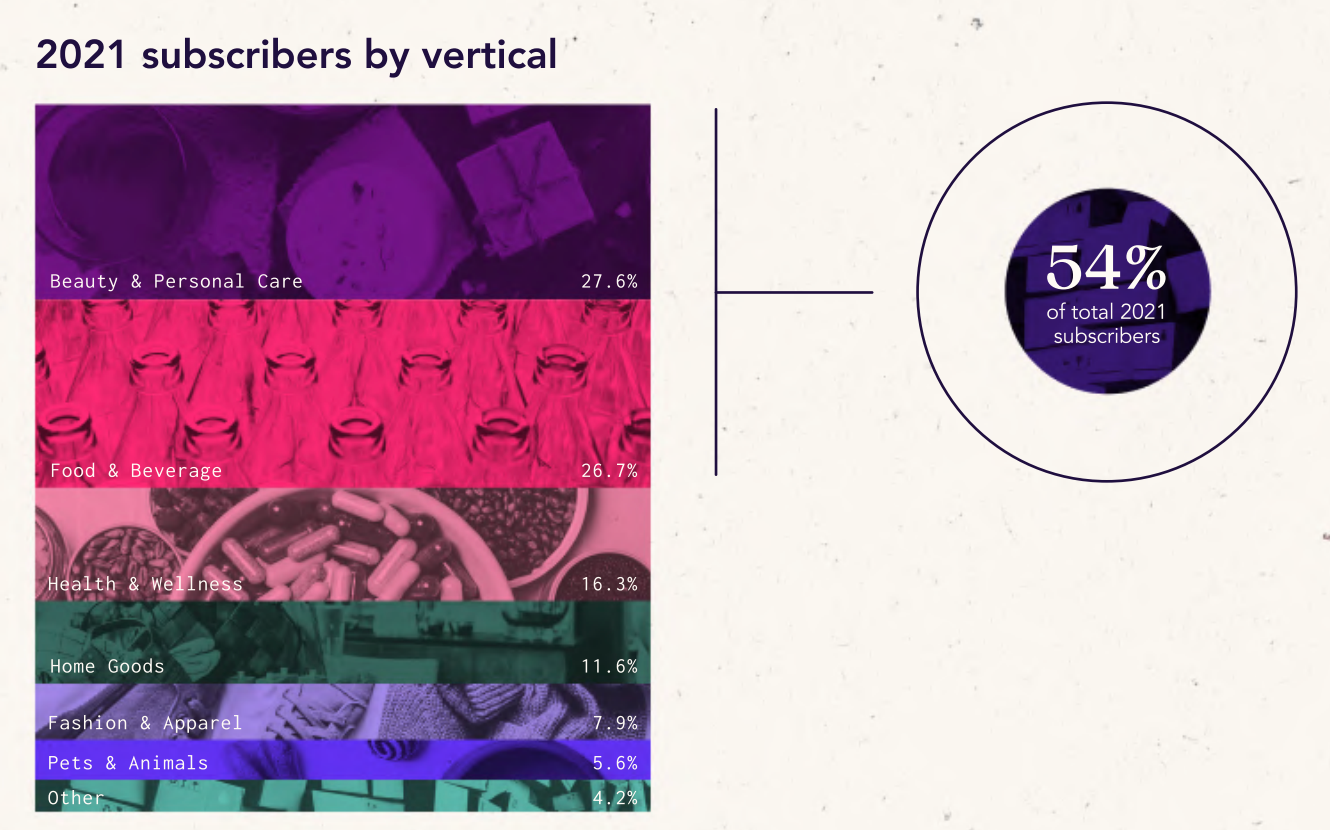

The subscription model has taken off over the past few years. This is partly due to the convenience and affordability of the services, partly because of the COVID-19 pandemic. Post-COVID, an increasing number of products and services are now available on a subscription basis.

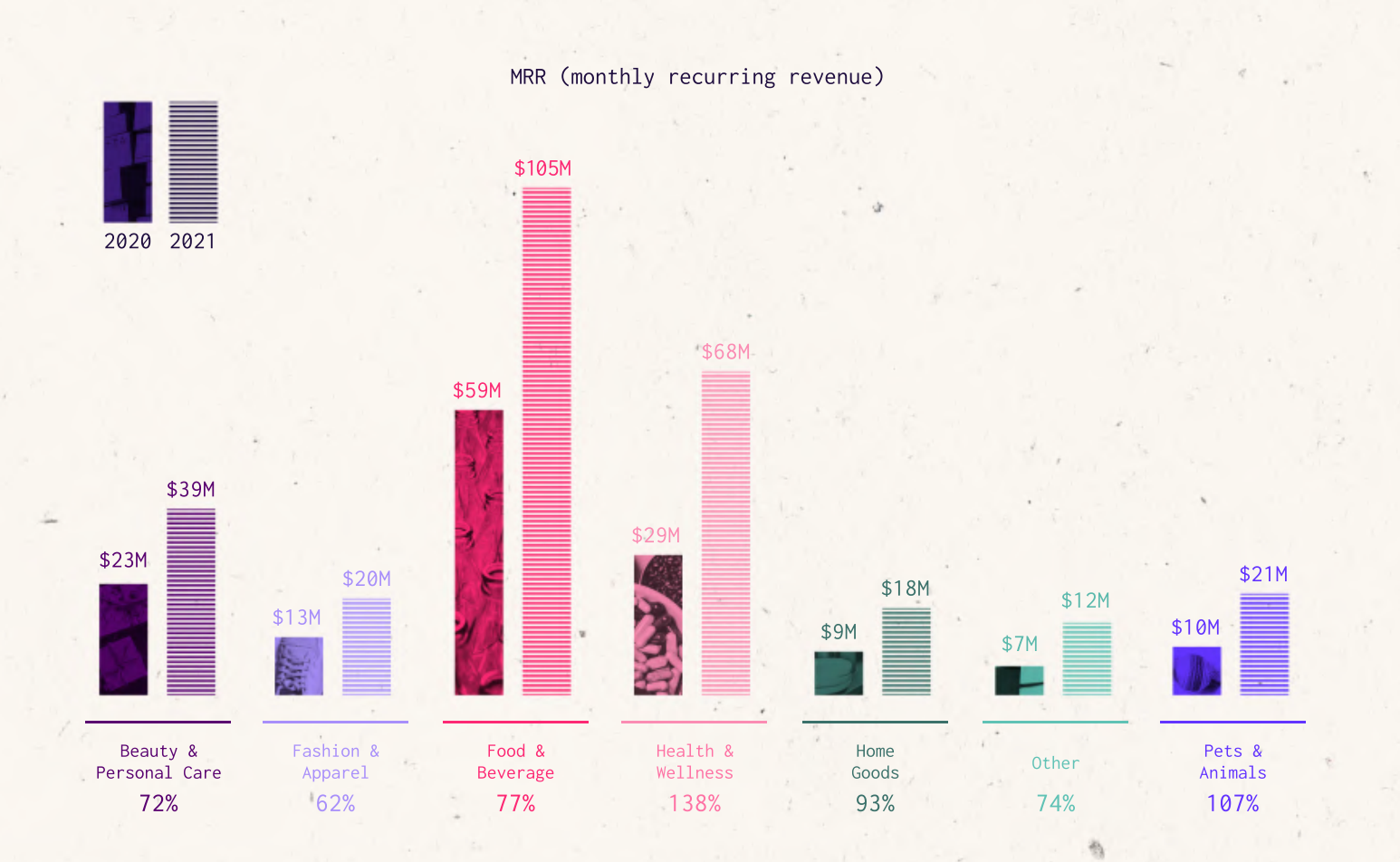

Subscription-based companies have succeeded in various industries, most notably in the beauty industry and food sectors. Recharge’s The State of Subscription Commerce 2022 report found that, when combined, beauty and personal care and food and beverage made up 54% of 2021’s subscriber pool.

![Screen Shot 2022-11-06 at 16.01.56.png]()

Source: The State of Subscription Commerce 2022

Other popular verticals for subscription services included: home goods, fashion and apparel, and pets and animals. Even though the subscription economy is still in its infancy, it’s growing rapidly.

From 2020 to 2021, health and wellness saw the largest increases in monthly recurring revenue (MRR) from subscriptions, with merchants seeing over 138% MRR growth. Pets and animals merchants saw average MRR increase by 107% over the same period.

![Screen Shot 2022-11-06 at 16.06.28.png]()

Source: The State of Subscription Commerce 2022

Subscriptions allow you to build lasting customer relationships. They also offer customers stability and reliability in a constantly changing world.

6. Personalization with zero party data

Ecommerce personalization has been a hot topic, and for a good reason. Personalization programs yield up to 15% higher conversion rates and 20% higher customer satisfaction rates.

Personalization, in short, is when a shop uses unique customer data to show dynamic content. What a customer sees is based on their demographic segment, browsing history, past purchases, device, and more.

As online shopping becomes more omnichannel, or having multiple channels influence purchasing behaviors, retailers are adapting their marketing strategies. You have endless options to reach your customers from emails to TikTok ads and text messages.

Rather than guess what messages or products they’ll respond to, you can use zero-party data to learn who your customers are. Zero party data refers to any information a customer shares with you, such as their shopping habits or preferences, in exchange for better shopping experiences.

Shoppers are happy to give brands this information, too. In Octane AI’s latest Ecommerce Consumer Behavior Report, 71% of of surveyed consumers said they’d share personal information with a brand if it meant getting personalized recommendations.

In a recent tech upgrade, Walmart continued to invest in personalization. People can now try on clothes using their own photos with the brand’s virtual apparel try-on feature. “By making it personalized, it helps narrow that decision-making for them because we know who they are, we know what they’re shopping for,” Brock McKeel, SVP of site experience at Walmart, told Modern Retail. “We get to know them.”

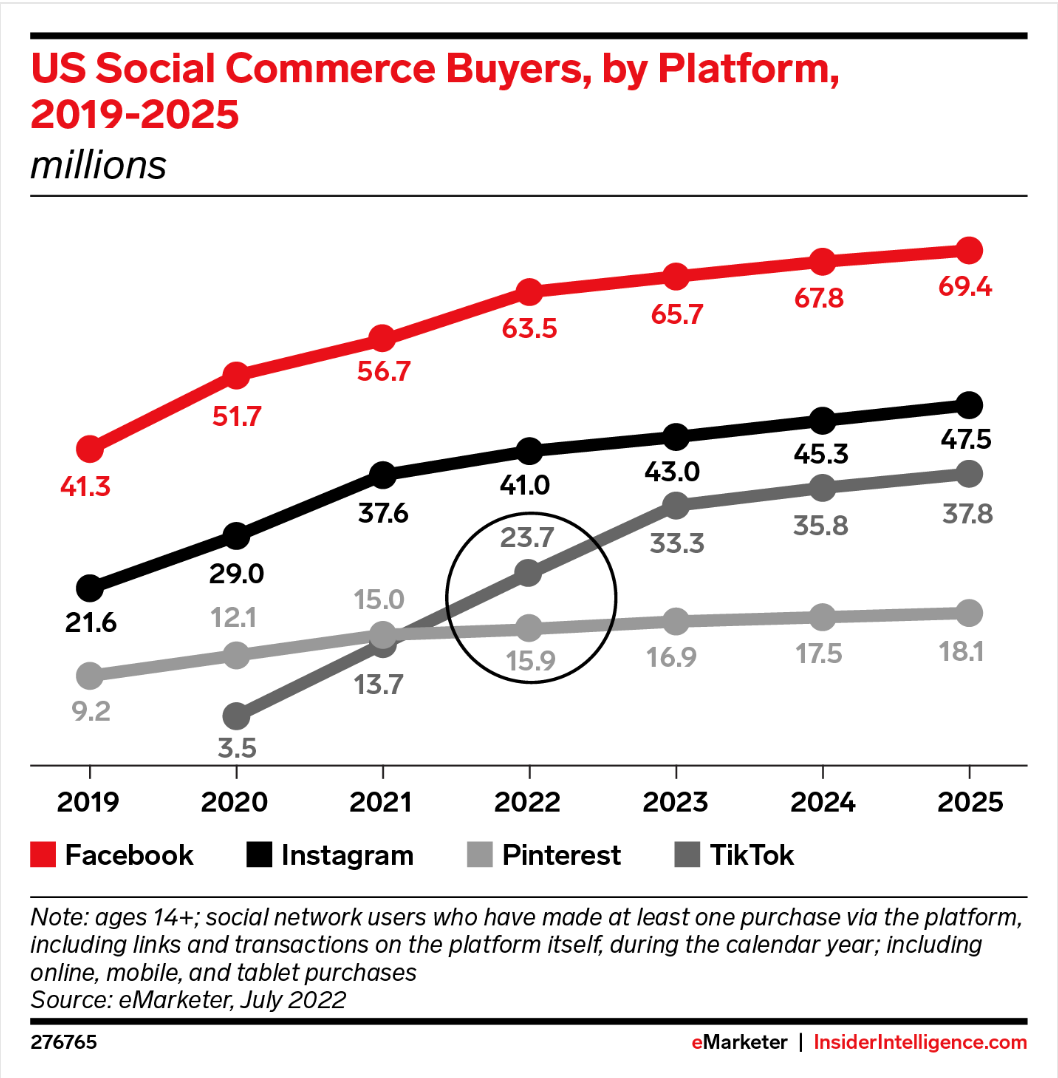

7. More social commerce spending will take place on TikTok

Facebook and Instagram have led the social commerce movement, but TikTok is right behind them. TikTok has become a powerful social media platform for product discovery and ecommerce. Brands like Adidas and Chipotle have had major success with their TikTok campaigns, and many more are following suit.

But TikTok has become much more than an emerging video app. It’s become the home of shoppable entertainment. Some 51% of users are more likely to discover relevant products from an ad, according to a recent TikTok study by research firm Material.

Insider Intelligence also reports that TikTok surpassed Pinterest in number of US social buyers for the first time in 2022.

![Screen Shot 2022-11-06 at 16.23.51.png]()

With so many people using TikTok to discover, research, and review products, it’s clear they want TikTok to become part of their shopping journey. According to the study, 61% of TikTok users have engaged in ecommerce behaviors on the platform, and 48% are interested in making a purchase on or from TikTok in the next three months.

Brands that can play to the strengths on TikTok will be able to get more sales from social customers.

8. More brands will adopt the direct-to-consumer-first model

DTC ecommerce sales have more than tripled since 2016, bringing in more than $128.33 billion in 2021. Insider Intelligence expects we’ll reach $212.9 billion by the end of 2024.

DTC brands make up approximately 13% of all ecommerce businesses in the US, according to a study by PipeCandy. New brands using a DTC-first model benefit from easier market entry, faster and cheaper fulfillment, and higher customer lifetime value compared to traditional retail.

In fact, traditional brands like Nike have shifted to a DTC-first model in recent years. Its direct channels now comprise around 35% of its profits.

Beyond the money, consumers simply prefer the experience DTC brands provide. One study found that 61% of consumers say individual brands offer a more personalized experience.

9. Resetting pandemic shopping behaviors

While pandemic fears ease and people head back into the world, chances to dress up are becoming more common.

A Klarna and Glossy study found that people spend more on fancy clothes and items for comfort and self-care. It found that “glamorous items” like cocktail dresses and fake lashes surged in sales between October 2021 and March 2022, as did work-from-home clothes like comfortable pajamas.

Compared to the same six-month period a year prior, Klarna data showed the following sales trends in glamor shopping categories:

- Blemish care and hair gel were up 400%

- Fake lashes were up 2,000%

- Curling wands were up 583%

It also found:

- Sleepwear was up 348%

- Face care was up 7,533%

- Bath oil was up 2,897%

What does this data suggest? That consumers are basing buying decisions on comfort and well-being. They aren’t afraid to spend on a nice wardrobe for evening events, but they also want to come home, jump into some comfy fits, and relax.

Final word

Now that we’ve seen the consumer behavior trends for 2023, it’s time to take action. Start by adopting one or two of these trends for your business. Find which works for your audience and then build a marketing campaign to target these behaviors throughout the customer journey.